The public interest?

There hasn't been much time to digest the fine points of the regulatory jihad rolling over Yorkton Securities and its former CEO, Scott Paterson. During the company's spectacular history of investment achievement, including the underwriting of hundreds of new firms, it's quite possible some rules were broken, maybe even some laws. If so, let the punishment fit the wrongdoing.

The trouble with the Ontario Securities Commission staff allegations against Yorkton Securities is that there are no allegations. Somewhere in the 32-page statement of charges released yesterday one would expect to find concrete allegations that take us back to sections of the securities act. Insider trading? Stock manipulation? Witchcraft? With one minor exception, there are none. The only charge is that Yorkton, Paterson and other company employees engaged in "conduct contrary to the public interest."

The public interest sections of the Ontario Securities Act are one of the great outrages of Canadian public policy. The "public interest" is not just a loophole through which regulators can drive trucks; it's an arbitrary transfer of power through which governments and regulators can dole out any tyranny that strikes their fancy. The public interest is never defined in the act, which means regulators can define as the go along.

According to news reports, Yorkton Securities and its former CEO Scott Paterson are to be fined $1-million each. And Mr. Paterson is to be sent out to pasture for two years at the age.

According to news reports, Yorkton Securities and its former CEO Scott Paterson are to be fined $1-million each. And Mr. Paterson is to be sent out to pasture for two years at the age 38, punishment some say could end his career as one of the brightest investment players to Canada in the last decade. But why? Looking through the allegations, it's hard to find how any public interest was damaged at Yorkton. Securities regulators have a long list of behaviors they find objectionable, but most do not amount to an assault on the public interest that would want the warrant the current regulatory assault on Yorkton and Mr. Paterson.

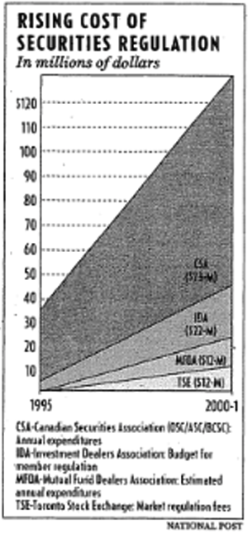

More will come out on the Yorkton Paterson allegations in the days ahead. In the meantime, we should bear in mind that the securities commission has a major public relations war it is trying to win. The commission is now stacked with high-paid legal staff and fat budgets and must begin to prove to the world that it is doing a great job. Nailing a high-flyer like Scott Paterson serves the cause.

Earlier this year, OSC manager of investigations David Butler made it clear the commission wanted big game to hang on the wall. "We're prepared to take on high-profile people because they are the best way to send a message of deterrence." Mr. Paterson's style - brash, young and arrogant - fits the

high-profile criteria.

The securities regulators have also stretched at least the spirit of the law during their past runs at Yorkton. Earlier this year the OSC forced Yorkton's clients to report on an OSC investigation, even though the invetigation had not been completed. And yesterday we learn that the British Columbia Securities Commission plans to take on Yorkton again over stock manipulation, even through the stock exchanges have already cleared the company on similar charges.

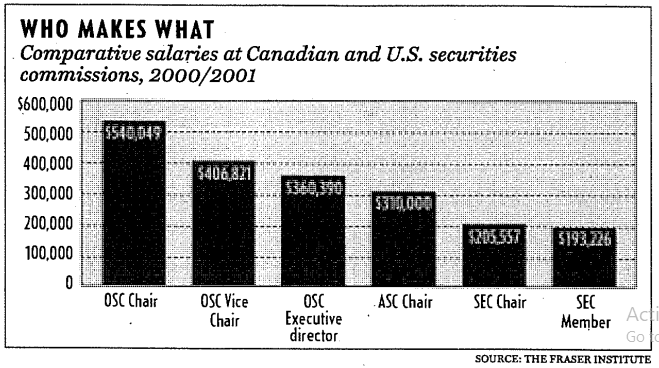

About month ago, when the Fraser Institute produced a report on securities commission salaries, the commissions dismissed the information as irrelevant. A B.C. commission official said the Fraser Institute study was "a classic case of a self-interest study.

Sorry, who's self interest would the Fraser be pushing?

Canada's securities regulators are now a growing business, with high salaries and budgets to explain and defend. After two years of public pursuit of Yorkton, it's still hard to tell who's pursing the public interest or self-interest.